- Hits: 1844

4Cs of financial wisdom

Today let us understand 4Cs of financial wisdom and let us assess which type of individual are we based on the combination of these 4Cs.

C1. Creation of income (Through any economic activity like business, job)

C2. Consumption of income (spending)

C3. Continuation of income (making sure we receive money even if income is not created)

C4. Conservation of income (making sure that in case of any catastrophic event, we or our family do not lose much)

Mostly people are concerned with No. C1 & C2 but do not think of C3 & C4. C1 & C2 improve current state of life, they give a feeling of luxury but it is at the cost of future security.

Most of us never think or try to achieve C3 (Continuation of income) & C4 (Conservation of income). So the question is how can these be achieved? C3 & C4 can be achieved only when C1 (Creation of income) > C2 (Consumption of income). So make sure that you earn enough to save.

Creation of income for most of the people is certain. But it is what they feel. In reality it is not so. One can lose income because the business runs into losses, there may be natural calamity, termination from job, disability, prolonged illness, death and much more. This can impact not only us but also to our dependents.

Categories of individuals based on 4Cs.

| Category | Component consideration | Type of individual | What it means |

| 01 | Only C1 & C2 where C1 > C2 | They care for savings only | Such individuals save but lack investing and being adequately insured. They will have a lavish current life but uncertain future. |

| 02 | Only C1 & C2 where C1 < C2 | They care for spending only | Such individuals have a certain future which is dark and they will be dependent on others |

| 03 | C1, C2 & C3 | They care for savings & continuation | They will have a good present and uncertain future in case of major illness or death |

| 04 | C1, C2 & C4 | They care for savings and conservation | They will have a good present and uncertain future in case of loss of ability to earn |

| 05 | C1, C2, C3 & C4 | Perfect financial planners | Such individuals will have a stable life. They may envy other 4 category of individuals in short term but over long term other 4 categories will envy them |

So how to achieve Continuation & Conservation???

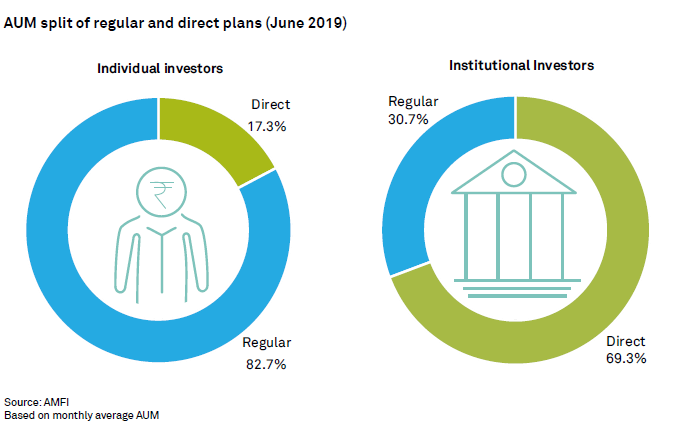

Continuation can be achieved through investing. Investing in Stocks, Mutual funds, Real estate, LICs certain types of endowment/cash back/annuity policies (Assets which can give a stream of income)

Conservation can be achieved through insurance (Health insurance, Life insurance, Household insurance, Auto insurance). One must have insurance at least 10 times of their annual income.

An exercise for all:

Take 2 chocolates of 1 rupee each. Remove the wrapper of one of the chocolate, drop both of them on the floor and stamp on them wearing footwear. Now you have to eat any one of them. Which one will you eat? Obviously the one with wrapper / cover. The wrapper must be costing 20 paise but it maintains the value of chocolate. This is the importance of conservation (Insurance).

Assess your self. See where do you stand in terms of 4Cs of financial wisdom. Check how do you stand in terms of savings (C1 - C2), check if you have planned for continuation of income in case of sudden income loss, check if you are adequately insured (at least 10 times of annual income)