Planning for a home loan? Read this article before you fix the repayment term.

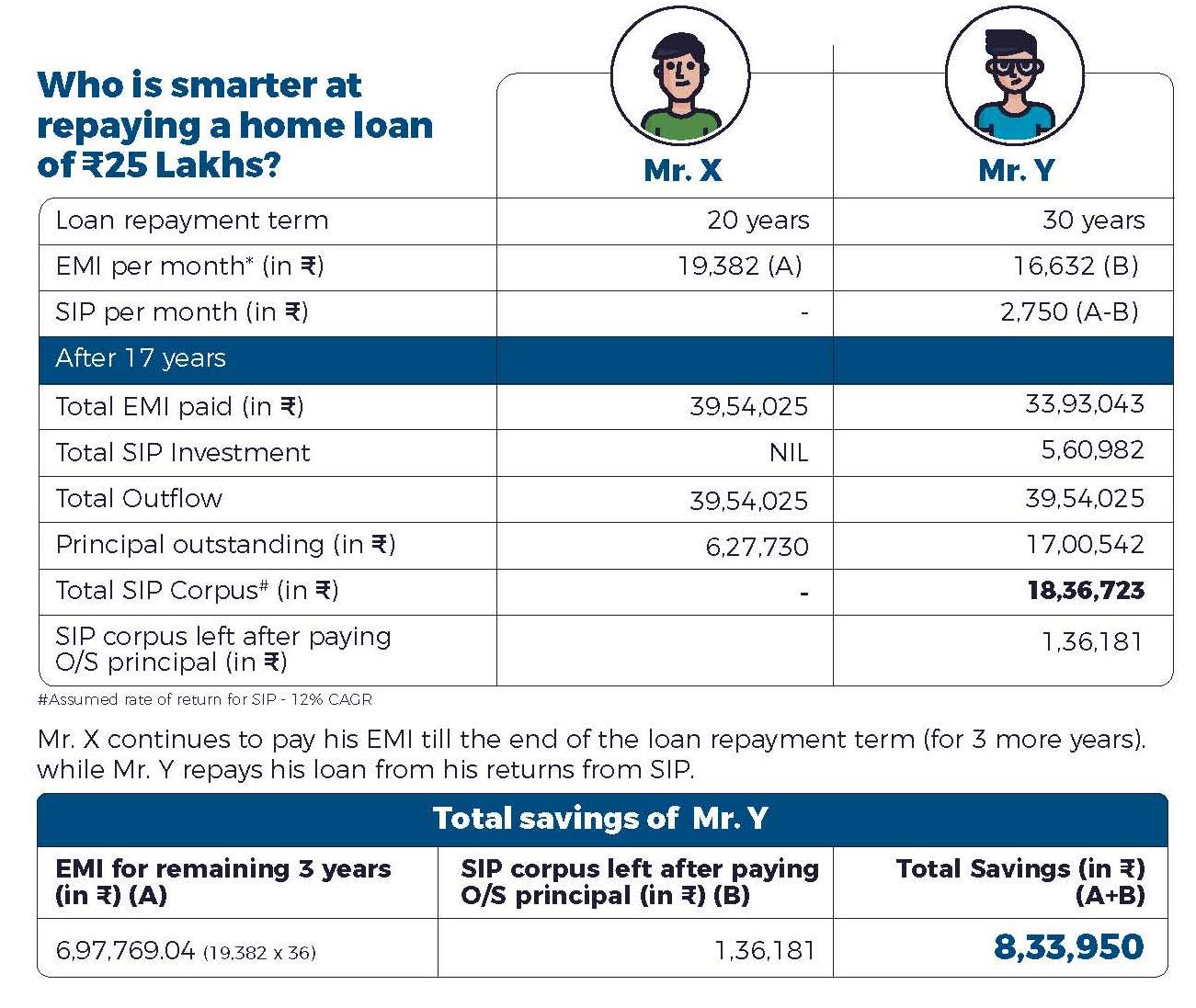

Let us assume that one is planning to get a home loan of Rs. 25,00,000 at an interest rate of 7%. Approximate EMI payable for 20 year period would be Rs. 19382/month while approximate EMI payable for 30 year period would be Rs. 16632/month. The difference in EMI for 20 and 30 year repayment term comes to Rs. 2750/month.

Let us assume Mr. X has taken a home loan for a period of 20 years while Mr. Y has taken a home loan for a period of 30 years and invested the differential amount of Rs. 2750/month into SIP. Both Mr. X and Mr. Y will have same monthly cash-outflow. Let us see what happens next.

So, Mr. Y not only pays off his home loan in 17 years, but also has a surplus of Rs. 1,36,181 with him and has a lower cash-outflow of Rs. 6,97,769 thereby giving a total benefit of Rs. 8,33,950. So dear readers it is essential to understand the power of compounding. SIP may be small but if continued for a long period of time, it can create wonders.