The country of millennials is at crossroads. While the seniors would prefer the age-old ways of personal meet ups, the generation Y is opting for online snap messages. When the septuagenarians seek solace in golden hits of 50s and shastriya sangeet, youth are tapping to rap and rock.

While the seniors still find confidence in fixed deposits (FDs) and public provident fund (PPF), but are those the right way to go about investments in the current era, when the pace of inflation is neck-to-neck with the interest rates?

So, when you are zeroing down on tax-saving investments for the year, don’t forget to change with the era. A dash of equity is what would dress up your portfolio in tune with the time. There are three tax-saving instruments, which help you stitch equity in your portfolio — namely Equity linked savings scheme (ELSS) offered by mutual funds, Unit-Linked Insurance Plan (Ulips) from life insurers and National Pension Scheme (NPS) by Pension Fund Regulatory Authority.

ELSS, which have generated a 5-year return of 15.87%, and 10-year returns of 17.24%, would be the right fit.

Hemant Rustagi, CEO, Wiseinvest Advisors, nods in affirmity, “The other tax-saving instruments are debt-heavy. Even NPS, after the changes brought about, restricts the equity component to 75% and it starts decreasing by the time you are at the peak of your career. Only ELSS offers the long-term advantage of equity.”

What does one look for in a tax-saving investment option? Value for money, good returns, safety low-lock-in, ease of investing, transparency, one that syncs well with your overall investing objectives. ELSS offer all of these with the lowest lock-in of 3-years compared with 10-years plus of ULIP, retirement age lock-in of NPS, 15-year lock-in of PPF and 5-year lock-in of NSC, Senior Citizen Savings Scheme and tax-saving FDs.

Zaharah Sheriff, founder at Fedwinteg Knowledge Series, says “In the game of investments getting the asset allocation right is far more important than anything else.”

Tax and ELSS

A brickbat which has been raised against ELSS is that the gains from the investment exceeding Rs 1 lakh would be subject to capital gains tax of 10.4%. In response to the tax axe, Sheriff says, “When you are paying a tax, one should assess, the 10% of tax is being deducted as a percentage of what. If the gains are higher than other debt and hybrid tax-saving investments, then you would always end up gaining better compounded returns.”

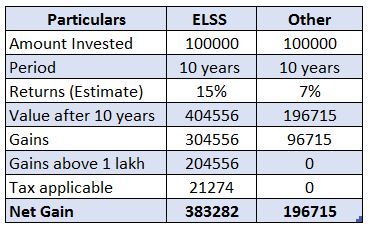

Take for instance, an amount of Rs 1 lakh being invested for a period of 10 years in a mutual fund, where the gains are taxed and another in a debt or hybrid instrument earning lower returns without any tax on gains.

Assuming the mutual fund investments earn 15% returns, the value would swell to Rs 4.04 lakh, while the other investment earning 7% would grow to Rs 1.97 lakh. Even if one has to bear the tax of 10.4% (amounting to Rs 21,273 for the gain above Rs 1 lakh in MF), you would be better off with Rs 1.86 lakh on the overall investment in MF compared with the other debt or hybrid investment.

Hence, Rustagi rightly points out, “When the 10-year returns are in the range of 20-21%, even after paying a 10% tax on the gains you are still better off in the long-run.”

Selecting schemes

With more than 200 tax-saving schemes available in the market in different plans, how should one select the best ones?

Durgesh Pandya, MD, My Advisor Finserv, suggests, “Opt for schemes that are 5-10 years old and not the ones that are at the New Fund Offering (NFO) stage. Zero down on a reputed fund house that has a stable fund management team, instead of linking the decision to cost of fund management and short-term performance. Select one or maximum two ELSS schemes to park your funds every year and stay invested for the long horizon.”

But investing the money in a single shot isn’t what advisors recommend. The situation gets a little tricky for those thinking of a Systematic Investment Plan (SIP) through the year. “Instead of starting a SIP, it is better to create a kitty in a liquid fund and invest as lumpsum or in two-three tranches in the ELSS scheme to ensure that you aren’t stuck with a longer-lock in on each investment tranche and get the gains of market ups and downs.

Ignore lock-in for wealth creation

Sheriff suggests that “Even though ELSS has a 3-year lock-in, one should always treat equity investments with a 5-year horizon.”

Moreover, when investors lock-in funds in other low-return instruments for a longer-horizon, a similar attitude and stickiness in ELSS would be rewarding.

Pandya exemplifies, “Even though the tenure of PPF is 15 years, majority investors are habituated to extend the tenure by 5 years twice, investing Rs 1 lakh for a total period of 25-30 years. If investors stick to for the same time horizon, then they would garner a wealth of Rs 5 crore on the investment of Rs 30 lakh even if we go by a conservative estimate of 15% returns on the investments.”

Though there is a lock-in of 3 years, one should consider it as an investment buddy for a long-term perspective. “Over the 2-8 year time frame, ELSS has outperformed even diversified equity funds. The lock-in has acted as an advantage from fund management perspective as the fund manager is able to take long-term bets by avoiding redemption pressure,” Pandya adds.

Thus bid your tax woes adios and go with the right choice.